The Leveraged Structure - NMTCs 101

Shortly after a person begins investigating New Markets Tax Credits they encounter the term “Leveraged Structure” and then are barraged with unfamiliar acronyms. It can be very intimidating and confusing - but we can help.

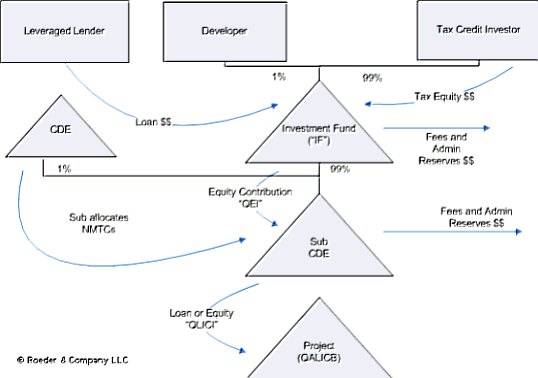

Below is a diagram that in one form or another appears in almost every discussion about NMTC transactions. Essentially, the structure is designed to leverage the tax credit investors equity, and thereby generate larger investor returns.

In the structure, a lender, usually referred to as the “Leveraged Lender” makes a loan to an entity that the tax credit investor has a majority interest in. Typically this is a limited liability company, but it can also be a corporation that the tax credit investor owns at least 80% of. The entity is referred to as the “Investment Fund”, or “IF”. The tax credit investor contributes equity to the IF equal to the net present value of the tax benefits that will flow through to them over the life of the deal. These tax benefits include the 5% NMTC in each of the first three years and 6% for the four years thereafter (an aggregate of 39%). The total capitalization of the IF, less an amount reserved for administrative expenses and fees, is then contributed to a Community Development Entity, or “CDE”. The capital contribution is referred to as a “QEI” or Qualified Equity Investment. It is the contribution of this capital that triggers the ability to take the NMTC. The NMTC taken over seven years equals 39% of the QEI. CDE's compete annually for the right to allocate NMTCs, and are granted that right by the U.S. Treasury through its adminstrative arm, the Community Development Institutions Fund or the "CDFI".

The CDE also reserves

some funds for administrative expenses and fees, and then uses “substantially

all” of the remaining QEI to fund “QLICIs” or Qualified Low Income Community

Investments. These are typically

loans, but QLICIs can be in other forms, including equity (but generally not

grants). QLICIs are usually

in the form of low interest, little to no fee, deeply subordinated loans.

The QLICIs are made to “QALICBs” or Qualified Active Low-Income Community Businesses in “LICs” or Low Income Communities. QALICBs can be, among other things, commercial real estate projects or renewable energy projects. QALICBs typically must agree to provide certain community benefits, but in exchange they can expect to receive a NMTC derived ecomomic subsidy to the project of between 15% to 20% of the total project cost, depending on the tax credit investors required yield and the complexity of the project structure. Under the NMTC program, the subsidy is meant to get deals financed that otherwise wouldn't "but for" the utilization of the NMTC. This notion is often referred to as the "But For Test".

The NMTC program requires compliance with various regulations in order to avoid recapture of the tax credit and various rules to remain qualified for future CDE allocations.